What is VAT?

The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It applies more or less to all goods and services that are bought and sold for use or consumption in the European Union.

As VAT is a consumption tax, in principle, it is borne ultimately by the final consumer. It means if you are registered as a VAT payer, you may be required to charge VAT on the items sold in European Union’s member countries.

And VAT is a general tax that applies to all commercial activities(eg. production, distribution, sale) for goods and services, which is different from the US Sales Tax.

According to VAT rules, POPCUSTOMS will charge on orders that ship to a customer in one of the EU member states based on the shipping address. However, if you are registered as a VAT payer, you are able to reclaim VAT used for your taxable supplies by including POPCUSTOMS VAT invoice during VAT declaration.

Check more about VAT https://ec.europa.eu/taxation_customs/what-vat_en

How is VAT calculated and charged?

When you place an order or the order is synced from your store, the VAT will be automatically calculated with Ship-to country VAT rate.

Given POPCUSTOMS fulfills orders in China, all orders will be shipped from China. The VAT rate applied is the ship-to-country VAT rate and can range between 15% to 27%.

Check the EU countries’ standard VAT rates https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates/index_en.htm#shortcut-6

If you’re selling on an online marketplace such as Etsy, the marketplace will collect VAT from the end-customer, and we’ll collect it from you as a store owner. It’s because they’re treated as two separate transactions—first, we sell you a product, and the transaction is between us. Then your customer buys the product from your online store, and the transaction happens between them and your store.

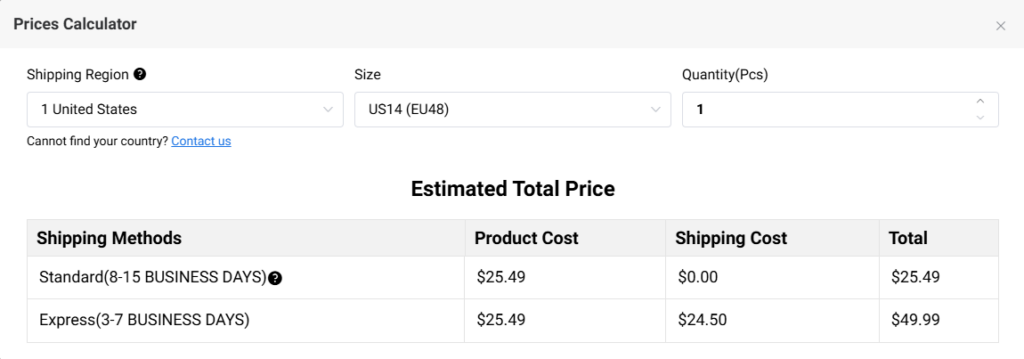

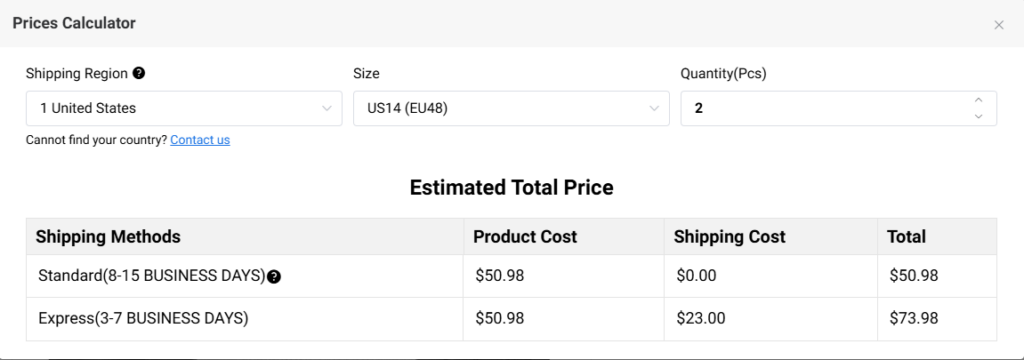

As VAT is placed on each stage of the supply chain (eg. production, distribution, sale), all services need to be applied with VAT. However, the shipping service is a little complicated in POPCUSTOMS. So we only calculate VAT based on the product price currently.

If you’re selling on an online marketplace such as Etsy, the marketplace will collect VAT from the end-customer, and we’ll collect it from you as a store owner. It’s because they’re treated as two separate transactions—first, we sell you a product, and the transaction is between us. Then your customer buys the product from your online store, and the transaction happens between them and your store.